Timisoara_Med 2022, 2022(2), 3; doi:10.35995/tmj20220203

Review Article

Pharmacy 4.0—The Potential of Integrating Digital Technologies into Daily Healthcare Processes at Pharmacies

1

Business Administration, Baden-Wuerttemberg Cooperative State University (DHBW), Mannheim, Germany; fabio.liebenspacher@t-online.de

2

International School of Management GmbH—Gemeinnützige Gesellschaft, Mörfelder Landstraße 55, D-60598 Frankfurt, Germany

*

Correspondence: patrick.siegfried@ism.de; Tel.: +49-1577-9068623

How to cite: Liebenspacher, F.; Siegfried, P. Pharmacy 4.0—The Potential of Integrating Digital Technologies into Daily Healthcare Processes at Pharmacies. Timisoara Med. 2022, 2022(2), 3; doi:10.35995/tmj20220203.

Received: 7 March 2022 / Accepted: 3 June 2022 / Published: 25 August 2022

Open access

: TIMISOARA MEDICAL JOURNAL is a peer-reviewed open-access journal.Abstract

:This scientific paper aims to collect and analyze various digital technologies connected to pharmacies and Health 4.0. Thus, the goal is to give basic recommendations for actions for pharmacies to remain successful businesses in the digital future of healthcare. While the total health sector is growing continuously, the total number of pharmacies is shrinking. To be able to face the competitive pressure on the pharmaceutical market, pharmacies have to integrate more efficient digital technologies to be able to increase customers’ experience. Hence, the acceptance and attitude of the German society towards digital health solutions are examined using a short survey and a precise questionnaire. After a detailed analysis of the survey results and the questionnaire answered by a pharmacist, specific digital methods and technologies which make sense for pharmacies can be elaborated. As the future of pharmacies is still quite unexplored, while the health market is shifting to more efficient digital solutions, pharmacies have to adapt to current developments fast. Therefore, this paper can serve as a guideline for pharmacies in the rapid changes toward more digital markets.

Keywords:

pharmacy 4.0; digitalization in pharmacies; Germany; artificial intelligence; customer survey; recommendation for action1. Introduction

1.1. Relevance of the Topic

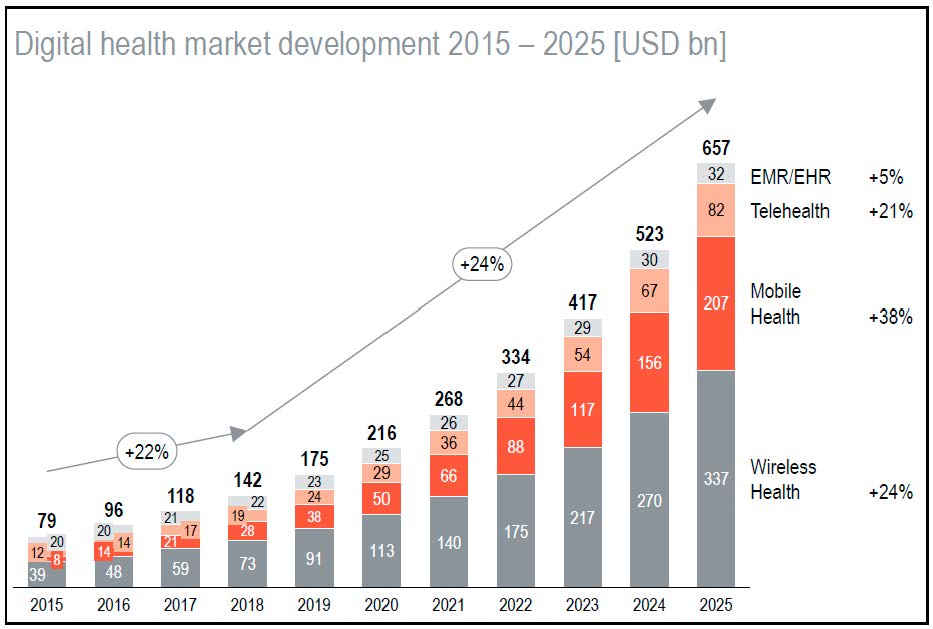

As a result of the COVID-19 pandemic, many people noticed that the healthcare sector with its processes and systems has not been adapting to current developments and technologies much in recent decades. Furthermore, demographic and socioeconomic changes in various parts of society raise patient expectations in many ways, thus reinforcing the emergence of efficiency-increasing technologies [1]. To be able to react to these developments properly, the actual point of care for patients is shifting towards partly digital, so-called hybrid health solutions [2]. Therefore, hybrid healthcare is combining the virtual and in-person care of multiple healthcare providers, leading to the strong integration of digital health solutions in daily healthcare [3]. Figure 1 shows that the digital health market is expected to reach nearly USD 660 billion by 2025, which represents exceedingly strong growth compared to other economic sectors [4]. In particular, the two areas of mobile health and wireless health are expected to grow strongly compared to other parts of healthcare, accounting for approx. 84% of the total healthcare market in 2025. In general, “Health 4.0” summarizes all developments and transformations of healthcare in terms of technological innovations and changes (e.g., AI or Big Data), and hence it can be seen as the digital twin of the principles and movements in Industry and Trade 4.0. [5].

1.2. Problem and Objective of the Work

Health 4.0 already takes place in nearly every process of the whole pharmaceutical value chain. Whether the development of mobile applications replaces traditional patient services or artificial intelligence has the main impact on the diagnosis of certain diseases. The absolute necessity of actual human capabilities shrinks drastically in some healthcare processes.

In general, pharmacies represent the end of the pharmaceutical value chain. Focusing on Germany, 18,753 individual pharmacies together had more than 3.3 million customer contacts each day in 2020 [7]. More than 160,000 people with special training are employed in German pharmacies [8]. In contrast to the health market growth, the number of pharmacies in the German healthcare market has been declining for several years. Looking at the direct point of sale, the traditional method of face-to-face consultation with patients prevails in contrast to more innovative methods. Today, pharmacists are responsible for precise medication management, which is the foundation for safe, effective, and sustainable pharmaceutical therapy. However, what if the current pharmaceutical technologies are adapting much faster than the rate at which actual changes can be implemented harmoniously? Could AI, Big Data, or other intelligent solutions simply replace the knowledge and everyday work of 160,000 employers in all those German pharmacies? Will there still be the necessity for stationary pharmacy concepts in the future, as we know them today? Additionally, how must these pharmacies adapt to remain successful businesses in the future?

This article is focused on the comparison of traditional pharmacy concepts with the multitude of opportunities, technologies, and innovations of future Health 4.0. The goal is to give various recommendations for actions for possible future pharmacy concepts so that pharmacies can remain successful in the digital future. Therefore, research is being conducted to determine which useful digital solutions can be integrated into traditional pharmacies. At the same time, pharmacy customers are being surveyed to explore the acceptance and urgency of the implementation of specific digital concepts. This article mainly refers to sales processes in German pharmacies, whereas background processes, such as medical procurement, accounting, or payment, are mostly excluded.

2. Digitalization in Healthcare—Health 4.0

Digital Health, Health 4.0, eHealth, wireless health, mobile health, online Health, smart health, telemedicine, etc.—there are many different words for digitalization in healthcare but no general explanation for this occasion yet. To start from scratch, digitalization in healthcare means integrating modern information and communication technology into daily healthcare processes. The primary goal is to simplify basic healthcare workflows throughout the whole value chain, such as pharmaceutical prevention, diagnosis, treatment, monitoring, or administration in healthcare facilities [9]. Besides the primary focus on central patient care, Health 4.0 also stands for the growing interconnectivity between main healthcare providers of the present and future. Therefore, the value and accessibility of data play a major role in optimizing standard procedures, hence gaining more efficiency in so-far time-consuming data procurement [10]. To summarize and collect patient records with all of the patient’s important medical history, demographics, laboratory data, and medication in one place, the Electronic Health Record was developed. As a result, the efficiency and quality of individual treatments can be increased due to data transparency, while all of the patient´s information remains private and confidential [11]. The German version of the EHR has been in use since January 2021, whereas, for instance, Austria already launched their electronic health record system in 2014 [11].

Health 4.0 consists of various developments and innovations within the three fundamental pillars: people, design, and technology. Regarding the first pillar, digitalized processes and new technology simultaneously mean rapid changes for patients and healthcare professionals, executing well-rehearsed and specified healthcare services every day, as they have learned during their vocational training. Thus, reaching overall better services can only be guaranteed if all stakeholders of the healthcare system, such as doctors, insurance companies, pharmacies, etc., get to know, understand, and accept the changes in their everyday job environment [12]. Furthermore, the design and structure of new healthcare products is decisive for the efficiency of use and therefore needs to be very well sophisticated. As a general rule: the better the design of healthcare products, the easier the actual usage for patients. Thus, users can extract more relevant and valuable information out of specific healthcare applications [10]. This becomes obvious in products concerning personal health monitoring, such as Apple Health [13] or Samsung Health (Samsung Germany, 2021), which are extremely user-friendly and easy to understand. Technology, as the third and last pillar of Health 4.0, plays an important role in this elaboration, which is explained in the following.

2.1. eHealth

Despite the fact that the Internet of Things has changed many different parts of life; the healthcare sector has mostly remained unaffected. Frequently, most people use the internet to Google specific disease symptoms, which enables Google Flu Trends to make an earlier prognosis of flu waves than most physicians [14]. However, healthcare still lacks suitable applications to exploit the full potential of Big Data and digital technology. In 2015, Apple launched one of the most popular Big Data healthcare solutions, called Apple ResearchKit, which clearly states the scope that digital health solutions could develop into in the future (Figure 2). ResearchKit generally works as an Open Source Framework to collect the medical data of a huge amount of people regarding health and chronic diseases by individual users of specific IOS applications [15]. This has enabled multiple apps such as the EpiWatch App to develop individual seizure detectors for epilepsy, and other applications have been used for the early detection of autism at the age of 5 years [16].

eHealth is the generic term for the digitalized version of the central healthcare system, which includes the modernization of the actual “old” telematic healthcare infrastructure, such as the EHR [17]. In addition, another focal point is on all kinds of developments connected to new treatment and care options for patients made possible by the use of modern information and communication technology, such as the internet [6]. A smaller part of the comprehensive eHealth term therefore represents the concept of smart health, to which both of the examples described above belong. Smart health describes the development of new and innovative business models in healthcare while using the multiple possibilities of the internet. Thus, eHealth and smart health both have the goal of connecting stationary healthcare ecosystems (hospitals, pharmacies, doctor’s offices, retirement homes, etc.) with modern digital healthcare technologies (EHR, E-Recipe, mobile applications, etc.) [9]. Furthermore, this similarity describes the most crucial difference to the following concept of health, named mobile health.

2.2. Mobile Health

Mobile health, or mHealth, generally describes the usage of various health-related applications on mobile devices, such as smartphones, tablets, or other personal health assistants. In other words, mHealth is the intersection between mHealth/smart health and mobile devices [18]. These individual health-related mobile technologies offer the potential to manage non-critical care within communities by the users themselves. Thus, patients can easily reduce the acute need for hospitalization, decrease their cost of care, and improve their daily quality of life. To distinguish the concept of mobile health from those mentioned above, it is important to emphasize that mHealth is based exclusively on mobility within healthcare solutions. MHealth can but does not have to have any overlapping points with stationary healthcare ecosystems, such as, e.g., pharmacies [19].

The importance of mHealth is constantly rising as more and more people around the world own mobile devices, such as smartphones. In 2021, the number of smartphone subscriptions worldwide surpassed 6 billion, and it is predicted that this number will continue to increase constantly in the future [20]. All in all, there were over 350,000 mHealth apps available in major app stores in 2020, which includes medical as well as health and fitness apps. The number of available apps has roughly doubled since 2015, driven by the increased smartphone adoption and ongoing heavy investment in the digital health market [21].

2.3. Artificial Intelligence

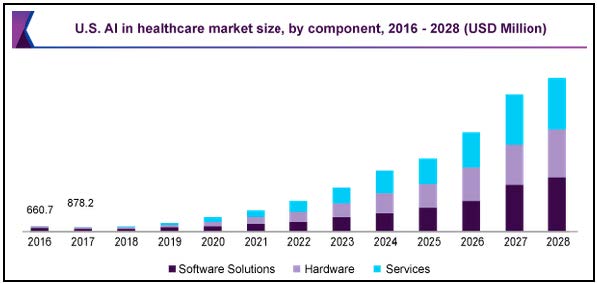

The potentials of the global artificial intelligence healthcare market are immense and have been subject to comprehensive work since the beginning of the 20th century [22]. Figure 3 shows that in 2020, the entire global market size of AI in healthcare was valued at USD 6.7 billion, while the global AI market only started in 2016 with a total market value of USD 660.7 million [23]. Due to this incredible market growth, AI is expected to expand at a compound annual growth rate of 41.8% from 2021 to 2028 [24].

Artificial intelligence is defined as the “ability of a digital computer or computer-controlled robot to perform tasks commonly associated with intelligent beings” [25]. Since the framework of human intelligence is difficult to narrow down, it is sometimes hard to draw the line on whether a system is intelligent or not. Therefore, multiple tests have been developed to determine the intelligence of computer systems using simple methods [26]. One of the first and most easy-to-use test procedures was invented by Alan Turing in 1950, which was originally called the imitation game but is nowadays widely used under the name “Turing Test”. Within this test, an actual person interviews a machine and another human, being unknown to him with no visual and auditory contact, by the use of a keyboard and a screen. If the interviewer cannot determine which of the two is the machine by the end of the test, the computer system passes the Turing Test and is considered to have an intellectual compacity equal to the human brain [27].

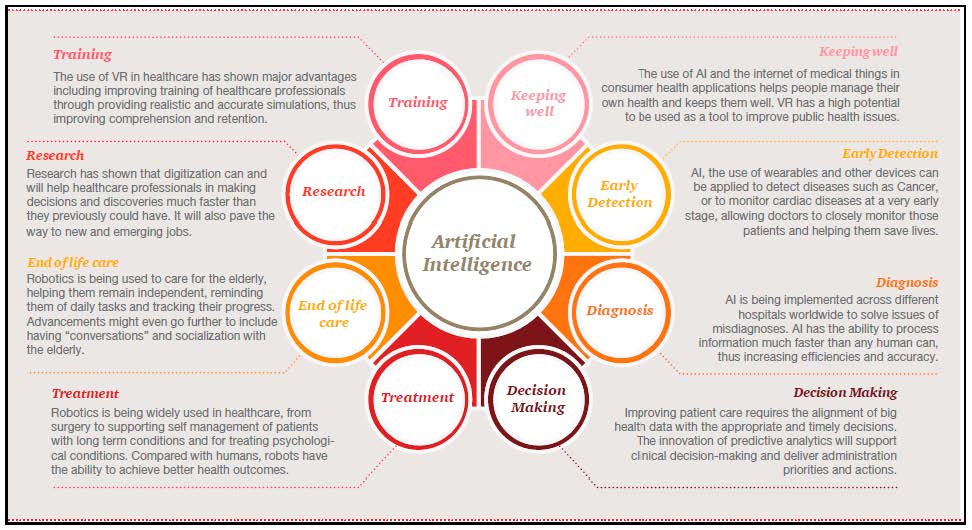

In healthcare, technologies based on AI could be deployed for the benefit of all stakeholders. The use of artificial intelligence in healthcare ecosystems could simultaneously increase the quality of care and reduce the costs of individual medical treatment. As the healthcare industry already generates a huge amount of potentially usable data, e.g., sensors, trackers, sleep patterns, diagnosis, treatments, etc., scientists have recently been looking for tools and methods to integrate and analyze this unstructured data mass. Figure 4 shows that AI has many fields of application in healthcare, reaching from sensors and IoT devices, to more complex systems that apply natural language processing and machine learning [28]. The most common way to use AI technologies lies within processes connected to direct and primary patient care to enable faster and more accurate treatment.

Currently, there are more people concerned about their health than there are physicians who can help them with correct advice and medical support. Thus, many people seek adequate medical treatment but receive no or very delayed suitable consultation appointments. To solve this issue, medical chatbots were developed to support patients in their self-care process by giving them more information about their symptoms and therefore the most accurate diagnosis possible [29]. Moreover, AI can be used in processes that are further away from primary patient care, such as the development of medicine or vaccines such as the Johnson & Johnson COVID-19 vaccine. Together, the MIT and Janssen R&D Data Science developed the DELPHI model, by which it was possible to determine where COVID-19 is likely to spike next. The scientists integrated COVID-19 surveillance data from all around the world with additional information about local policies and behaviors, such as whether people were being compliant with mask-wearing. Thus, being able to understand how the virus spreads around the world proved to be significantly important to the success of Janssen’s (the vaccine of Johnson & Johnson) clinical trials [29].

3. Pharmacies at a Glance

3.1. The German Healthcare System

Since this article focuses on the German healthcare sector, only this sector is discussed in more detail below. In general, the entitlement of the individual against the German state for basic healthcare in the sense of the assumption of costs for curative measures is anchored in the German constitution. Therefore, “the state must ensure sufficient, needs-based ambulatory and inpatient medical treatment, in qualitative and quantitative terms, as well as guarantee the provision of medicine” [30]. In Germany, more than EUR one million per day is spent on healthcare for the final consumption of health goods, services, and investments in the health sector or expenses for nursing care services [31]. Thus, the German healthcare system is primarily funded by the public sector, which is responsible for the collection of social insurance payments. Hence, public/private health and nursing insurance companies guarantee the assumption of costs for direct healthcare services, such as the cost of medicine, therapies, and medical aids or the remuneration of service providers (e.g., physicians and nurses). In contrast, expenses such as OTC medications and services that are not covered by health insurance are paid in whole or in part by the private households themselves [32].

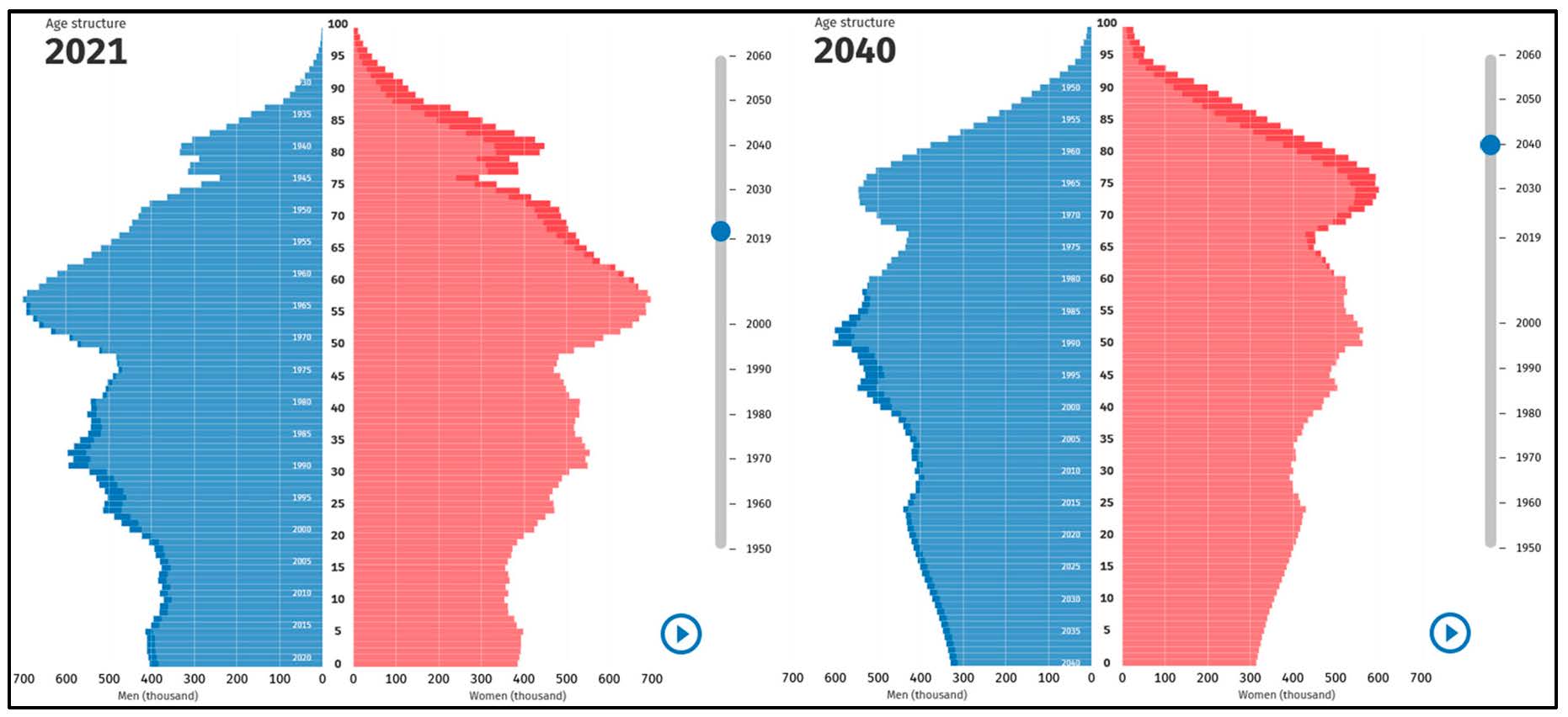

Furthermore, the German healthcare sector is challenged more and more by various megatrends, appearing to grow further within the next decades. One of them is the increasing number of elderly citizens living within Europe, which heavily collides with growing healthcare workforce shortages and decreasing social security contributions in total [33].

The average age of the German population in 2020 is 45.7 years, which is expected to grow to 49.2 years in 2050 [34]. As one can see in Figure 5, this would mean that the mass of people reaching retirement age would be significantly larger than the number of people starting to earn an income. Since retirement income is in most cases far lower than the income during active work duty, social security contributions also shrink drastically from retirement onwards. In contrast to that, the over 65 age group in OECD countries accounts for approx. 40 to 50 per cent of total healthcare spending, which would lead, without changes to the current healthcare system, to a collapse of healthcare provision by 2040 [35].

3.2. Pharmacies Today

To understand the necessity of the existence of current pharmacy concepts, it is important to know the basic key points of history. The etymology of the word pharmacy reaches back to the ancient Greeks, for whom the term “apothēkē/pharmacy” meant a warehouse for food and wine [37]. Therefore, the Greek term “apothēkē/pharmacy” derives from the word “pharmacy”, which means medicine, cure, or potion [38]. Over time, pharmacies evolved from food and wine stores to places where people known as shamans, priests, healers, diviners, physicians, apothecaries, pharmacists, chemists, or druggists prepared and administered drugs to patients. From then on, pharmacies combined the essentials of health, humans, and medicines in one concept, which has proven itself until today [39].

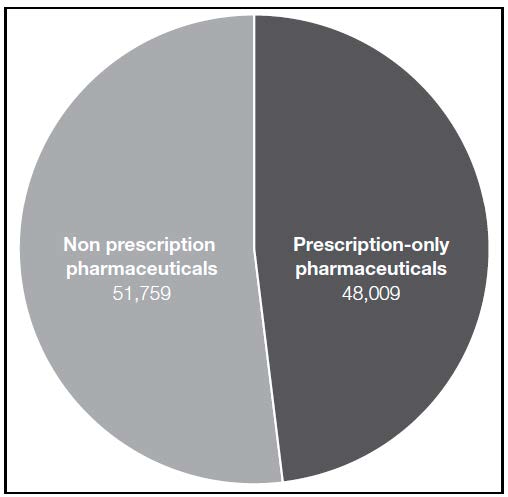

In Germany, there are currently 18,753 community/public pharmacies, and besides these, more than 2500 pharmacists are working in hospital pharmacies in about 1,900 hospitals all over the country [7,40,41]. The main difference between community/public and hospital pharmacies is that community/public pharmacies are accessible to the public and are therefore usually located outside a hospital, whereas hospital pharmacies are located in hospitals and only serve patients of the hospital. With over 20,000 pharmacies in total, there are 25 pharmacies covering 100,000 inhabitants in Germany, which is just below the EU average of 31 pharmacies per 100,000 inhabitants throughout all European countries [7]. To become a pharmacist in Germany, pharmacy students have to accomplish their degree by bypassing their third state exam, which includes gaining work experience in community pharmacies for over six months [41]. In the first state, working as a pharmacist means providing customers and patients with prescription and non-prescription medications combined with expert counseling and necessary pharmaceutical advice. Moreover, pharmacists are involved in the development, manufacture, testing, and evaluation of medications in pharmacy, research, and administration [42]. In general, a drug is a “substance used in the treatment, cure, prevention, or diagnosis of disease or used to otherwise enhance physical or mental well-being” [43]. Thus, medications can be separated into two main categories, which are prescription and non-prescription drugs. Prescription drugs must, in any case, be prescribed by a doctor and purchased at a pharmacy, in contrast to non-prescription drugs (OTC drugs), which do not require the specific prescription of a doctor and can be used with the information on the leaflet alone [44]. The total number of marketable pharmaceuticals in 2020 was 99,768, all of which received governmental approval in Germany. In Figure 6, we can observe that the division of prescription and non-prescription pharmaceuticals in the German healthcare market is relatively balanced.

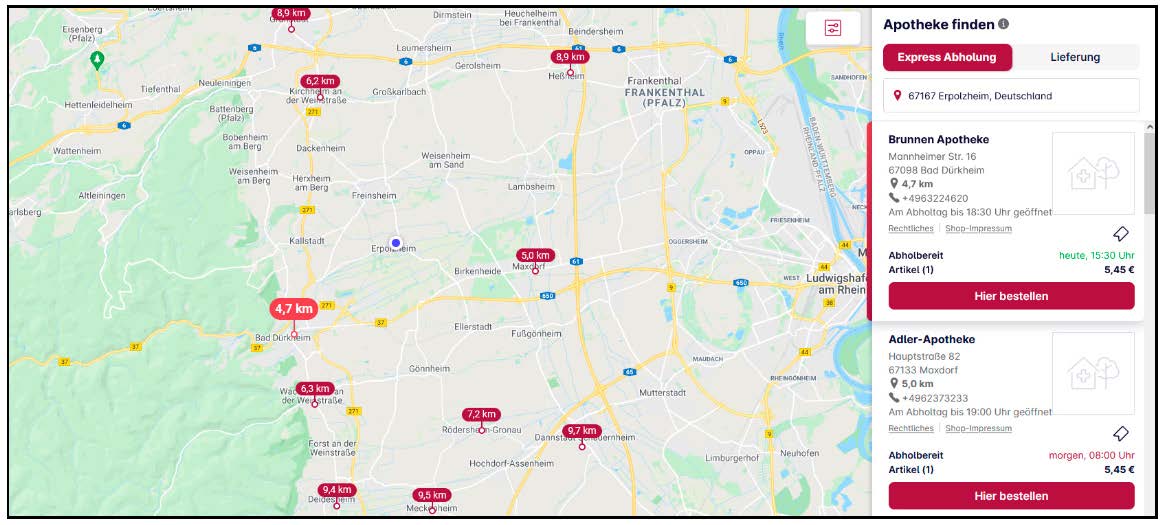

Even though the basic mission of pharmacies, to care for health and well-being, has never changed, the instruments and methods used to provide their essentials have been adapting to current developments, even if very slowly. According to social, economic, and political changes, pharmacies and pharmacy-connected processes are becoming increasingly digitalized. Whether recently launched online pharmacies are expanding their product portfolio or mobile apps are being developed with the purpose to replace various health services provided in pharmacies, it is obvious that some changes may be disrupting traditional pharmacy business models [45,46]. To maintain the efficiency of stationary pharmaceutical healthcare, economics tries to connect local pharmacies with online services of specific applications. One of these applications is gesund.de, which is available via an internet browser or mobile application on smartphones and tablets as one can see in Figure 7. With gesund.de, customers have access to offers and assortments of their local pharmacies and can easily purchase all sorts of non-prescription pharmaceuticals [47]. Moreover, the integration of e-prescriptions enables patients to pre-order prescription drugs in their local pharmacies and pick them up when they receive the order confirmation notification from their local pharmacist. Additionally, patients can save all of their health data in the integrated electronic health record and use this information to create order templates or reminders. Participating pharmacies, therefore, do not have to invest in the digitalization of their services themselves, but can rather use the services of gesund.de, which are well tested and mature [47].

3.3. Pharmacy 4.0—Future Pharmacy Concepts

Regarding the amount and speed of changes within pharmacies in the last decade, there are numerous different ways in which future pharmacy concepts could be adapted. The following is a brief outlook on the most concise development opportunities for future pharmacies, based on various changes to Health 4.0. To give it a little bit more structure, the following text is divided into two main parts. The first section, called pharmacies’ next steps, discusses possible technologies which could be integrated into current pharmacy systems in the foreseeable future. In the second section, called the future pharmacy, one can find more abstract ideas and changes lying in the far future of health and patient care. Either way, both parts are only focused on efficiency-increasing aspects within the process of providing pharmaceuticals to customers and patients. Background processes, such as purchasing, administration, etc., are mostly excluded in both sections too.

3.3.1. Pharmacies’ Next Steps

The concept “Pharmacy 2030” describes the official approach of pharmacists to adapt to current developments in healthcare and to maintain the quality of health services to stay consistently successful in the pharmacy business. Since this concept was already created in 2015, there are many new and additional adjustments to create a clear, up-to-date image of the future pharmacy. Thus, it is obvious that providing patients with concrete consultations on medicines and selling particular pharmaceuticals will remain at the center of pharmacists’ future everyday work. To achieve long-term, efficient, and safe drug treatments for every individual customer, a systematic medication management system must inevitably be introduced. Within such a system, all of the patient’s medication data are securely stored, analyzed, checked for risks, and, if necessary, monitored and supervised by the responsible pharmacist. To be able to implement technologies such as medication systems, the healthcare industry must develop better data-processing tools to digitally and transparently link the several healthcare providers with each other [48].

As mobile health is getting more relevant in the healthcare sector, it is of great importance for pharmacies to provide online and offline access to their range of products and services. Therefore, Walgreens, America’s second-largest pharmacy store chain, conducted a major study on the topic of digital sales strategies in the pharmacy business [49]. Surprisingly, the result was that 70% of Walgreens customers already engage through mobile applications and are three and a half times more likely to buy products directly at Walgreens. Hence, more than half of Walgreen’s total digital sales come from mobile purchases, which shows the great impact of integrating mobile solutions in established businesses [50]. Gesund.de, as the German equivalent to the development of Walgreens, already combines over 7000 pharmacies in one mobile application and is planning to further expand through the integration of various healthcare providers in 2022 [51,52]. Since gesund.de has only been available on the market since the third quarter of 2021 and already has more than 100,000 users in Germany, it is clear that the growth potential is becoming even bigger with increasing digitalization. According to this, mobile sales could become a major share of sales in future pharmacies.

Being able to buy all necessary medications online is a big change and advantage for customers in the German healthcare market. However, what if patients cannot or do not want to pick up the ordered drugs in their local pharmacies anymore? Improving pharmacy delivery systems would be the next step in building an economically sustainable pharmacy of the future in Germany. Therefore, America’s largest pharmacy store chain, CVS, can be used as an inspiration and example for the expansion of the pharmaceutical delivery service. CVS can deliver any products ordered online within hours directly to the customer’s home for free, starting at a monthly minimum order value of USD 35 [53]. Moreover, pharmaceutical delivery services contribute to minimizing the risk of infection from serious diseases, such as COVID 19.

Nevertheless, not everybody will use the offer to place orders online and get them delivered by pharmaceutical delivery services on the same day. Especially in the short term, patients will still use their local, stationary pharmacies to receive medical consultations and to buy their required drugs from trusted pharmacists offline. However, optimizing stationary pharmacy structures is also extremely important to be able to increase the efficiency in pharmacies and give pharmacists more time for individual, direct customer consultations. Figure 8 shows a specific example of various different technologies and concept changes, which could be integrated into the future pharmacy.

The fundament of future pharmacy concepts is the fully automated drug picking machine, which is illustrated in the upper figure as a big gray box in the top left corner. The benefit for pharmacies of using automated drug picking machines is that pharmaceuticals can be requested and delivered to numerous sales counters in and/or outside the pharmacy. Through the automation of the entire order picking system, the right drugs arrive at the right time and the right place, without the use of any labor of pharmacy employees or pharmacists. Moreover, the general stock management is also taken over by the machine, giving pharmacists even more time for direct interaction with patients. In addition, pharmacies must allow their customers to pick up pre-ordered or reserved medications directly at a digital counter without extensive consultation. Hence, patients can independently and easily pick up their drugs in and outside the pharmacy, which also enables the 24/7 availability of specific drugs without human labor. As an example, three different in- and outdoor digital sales counters can be found in the upper figure, of which only one is operated by pharmacy staff [55].

3.3.2. Future Pharmacies

After describing the most likely upcoming developments in the pharmacy business, it is much harder to predict changes which will arise from technologies that are currently not even close to being invented or fully developed. Therefore, the following section is mostly focused on potential applications of artificial intelligence in pharmacies and the development of virtual health. So, could AI replace humans in the pharmacy business, and will there be no necessity for stationary pharmacy services anymore in the far future?

Even though Germany has one of the highest healthcare standards in the world, the German health sector cannot reach the top of the health supply rate when it comes to pharmacy density. In many areas of German healthcare, there is a tightening shortage of skilled workers, including pharmacies, which mostly results in slow development and worse customer consultations [55]. According to forecasts, these developments will not change in the future, as there will be an increasing number of elderly people in society in need of medical treatment. Therefore, it is safe to reject the concept that human labor will be fully replaced in the pharmacy business. Innovative technologies such as AI will only support pharmacists in the healthcare of their patients to create the opportunity to significantly increase the intensity of healthcare provided to individuals by future pharmacists. However, how exactly can AI support pharmacists in general?

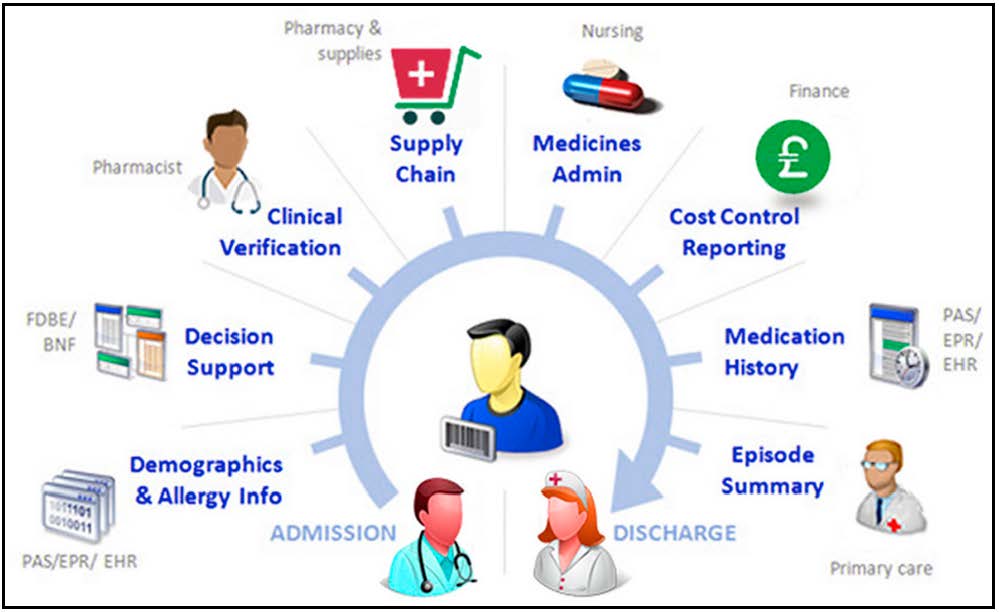

An early form of AI has already been integrated into pharmacies today, called the pharmacy management system. This system can easily store patient utilization and drug data, which enables the potential identification of drug-related risks and problems through clinical decision support screenings [56]. Although these technologies are the state of the art in today’s pharmacies, Figure 9 shows many ways to extend the several specific functions. The next generation in pharmacy technology could be the integration of pharmacy information systems to identify drug-related problems based on patient data captured from the pharmacy system in time. Through the digital connection of all healthcare systems, pharmacists would have all relevant health data of current patients, which would reduce the workload of pharmacists to shoulder the responsibility of identifying serious drug-related problems. The result would be an almost complete elimination of medication mistakes, while pharmacists would have even more time for major patient consultations at the same time [57].

Moreover, pharmacies could use natural language processing to optimize their communication structures in many ways. For instance, a medical Siri could take phone calls from customers and process their needs and wishes immediately and fully digitally. To be more precise, if a patient knows exactly which medications he needs, he could order his drugs via phone (“Hey XX, I would like to order three prescriptions and have them delivered tomorrow.”). Moreover, he could get more information about specific treatments and personalized answers fitting to his health standards. Pharmacists therefore would not have to spend time on “easy to handle” patients and hence could focus on other topics [59]. The fundament for the efficient use of medical AI, machine learning, natural language processing, or other intelligent technologies is the increasing transparency of health data. Only in this way can all smart devices and health services develop their full range of functions, working together in a huge network of health data. It is important to note that having more specific health data for every individual clearly does not mean a loss of data security, such as the risk of unauthorized persons having access to personal data.

4. Analyzing the Acceptance and Willingness to Digitalize Pharmacies in the German Society

4.1. Analysis of the Questionnaire Answered by a Current Pharmacist

Adapting to innovations created by digitalization and automation is most definitely a fundamental survival factor for stationary pharmacy concepts. These developments were crucially catalyzed by the disruptive changes due to COVID-19, which proves even more so that every pharmacy should be proactively tackling the topic of digitization as a strategic item on their agenda. Stationary pharmacies must increasingly become healthcare companies in the coming decades. Whether individual pharmacies remain successful or not depends on owner and management levels, which have to adapt quickly to current changes. “The drive for innovation, entrepreneurship, management, and leadership based on the ideas of the health care professional will become decisive for future pharmacies.”

The total health sector is growing each year, whereas the total number of pharmacies in Germany shows a decreasing trend. Hence, pharmacies will be facing more competition in the healthcare market, where digitalization can be an opportunity or a risk for every individual pharmacy. Generally, end consumers expect easy digital (online) and analog (off-line) access to medications and offers provided by pharmacies. Therefore, the rudimental first steps regarding digital offerings should be the use of, e.g., Google My Business services as well as developing contemporary homepages and increasing social media activities. Within the analog sales sections, pharmaceutical consulting services should be digitalized, which is achieved in the first place by modern, digital sales screens and interactive displays. To be more efficient within background processes, warehouse automation is an issue to keep an eye on, especially in combination with 24/7 pick-up capabilities. According to this, AI will support pharmacists and physicians in areas where technology exceeds the capabilities of the human brain. As a result, pharmacists and their staff can focus more on their strengths rather than wasting time on unnecessarily complex processes. Thus, the pharmacy community needs to start working online rather than in the pharmacy to be able to survive healthcare market changes. Strengthening the image and perception of local, stationary pharmacies among end consumers will be decisive when it comes to competing against strong, international competitors (e.g., Amazon Pharmacy). As a pharmacist, the respondent named three fundamental steps which he would implement regarding digitalization in his pharmacies.

- 1.

- Big Data Analysis tool: Tracking all prescription and sales transactions (online and offline) to achieve similar customer knowledge to what is already available within the online retail market is of great importance for pharmacies. This way, every individual pharmacist can decide which steps to take regarding on- and offline technologies in more specific situations.

- 2.

- On- and offline changes: This knowledge should be used to integrate modern technologies and systems to enhance the consumer experiences in local pharmacies. Thus, this step depends on the customer base and wishes of every individual pharmacy.

- 3.

- Automation of the flow of goods: Using predictive enterprise systems interacting with consumer-based technologies enables consumer requests and expectations to be fulfilled in advance. Thus, pharmacists can focus more on actual patient care, rather than spending their time in stock management processes.

The outcome would be a pharmacy which is driven by the same fundamental idea as today but would rather function more efficiently, freeing up pharmacists’ time while fulfilling customer expectations to the best of their abilities.

4.2. Analysis of the Survey

It is necessary to know the customer’s view regarding digital and technological innovations in pharmacies to be able to enhance customer satisfaction with the integration of specific systems. How willing or unwilling customers are to use new basic technologies in pharmacies decides whether the integration is useful or not. Even though AI and other technologies have the capability of simplifying pharmacists’ everyday work, the change that comes with it can either help grow local pharmacy businesses or destroy current structures, leading to a loss of sales. Hence, knowing more about the purchasing behavior of pharmacy customers is crucial when it comes to strategic decisions of this level of importance.

To address this issue, 230 individual pharmacy customers were asked anonymously in a survey with a total of 20 specific questions. The survey with the topic “What influence does digitalization have on stationary pharmacies?” was online for two weeks, questioning Germans only. The first part of the survey asked for basic demographic information, which would later be relevant for calculating correlations between different questions and groups in society. Thus, this section asked for information regarding age, sex, region of origin, and type of health insurance. The second section dealt with basic pharmaceutical questions, such as the distance to the nearest pharmacy or the frequency of personal pharmacy visits within one year. Moreover, the third section contained more specific questions regarding digitalization in pharmacies and the willingness of customers to adapt to new technologies. Because of this, the third section played a key role in the analysis of the online survey.

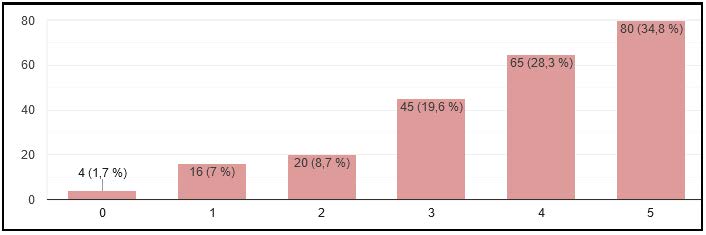

In general, the survey clearly stated that most people consider digitalization in healthcare as an important step, especially when it comes to stationary pharmacy solutions. According to Figure 10, 82.7 per cent of respondents consider digitalization to be at least important, whereby it is noticeable that the importance of digitalization in healthcare is increasing strongly, especially among younger respondents. Nevertheless, 69% of respondents over the age of 65 still consider digitalization in pharmacies to be important to very important, which proves that older generations still understand the shift to a digital world in pharmacies and can recognize the urgency behind it.

Taking a closer look at the survey results for people over the age of 65, it quickly becomes clear that this group in particular places great value on direct advice from their local pharmacist with a probability of almost 100 per cent. Hence, only 13% of the respondents over the age of 65 could imagine digital consulting in pharmacies, e.g., with apps or other mobile services, in the future. Even though younger generations are also using direct consulting services of a local pharmacist, these groups are more open to digital alternatives than older generations. In total, over 52% would consider taking digital consulting offers by a pharmacist in general. Looking at the frequency of annual pharmacy visits, respondents visiting pharmacies 0–5 times a year are much more willing to use digital consulting services offered by pharmacies than those who visit pharmacies more than once a month. Thus, the younger people are and the less they visit pharmacies, the more they accept future digital pharmacy solutions. According to the current status, this is quite a difficult fact to deal with in terms of digitalization in pharmacies, because these groups account for only a small percentage of monthly sales. Respondents visiting pharmacies more than once a month place great value on a trusting relationship with their pharmacist and are therefore rather averse to the digitalization of this connection. A large proportion of these survey responses arise from the lack of experience with digital pharmacy products and the lack of recognition of the actual benefit of this system.

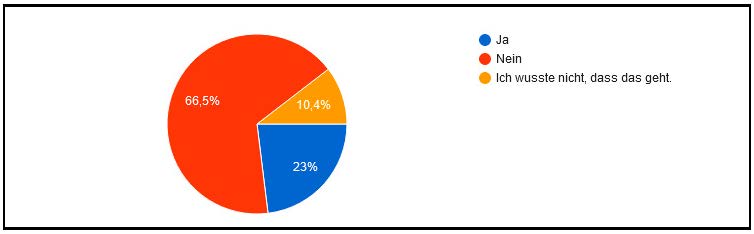

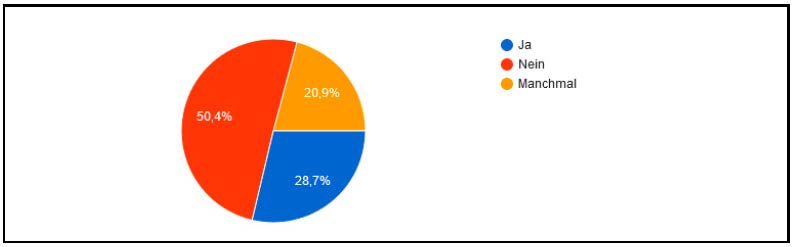

Moreover, Figure 11 shows that only 23% of all respondents stated that they are already using digital solutions connected to pharmacies, e.g., mobile applications. Comparing 23% of actual usage to 83% stating that digitalization plays a major role in pharmacies and healthcare, these numbers are inconceivably small. Over 66% of all respondents of all ages are currently not using any digital interfaces regarding the purchase of medical products or medical consulting in pharmacies. Additionally, one-tenth of all respondents today are not even aware of the opportunity of using digital pharmacy-connected technologies. However, about 60% of all respondents use mobile apps at least several times a month for personal health concerns. This simply shows that pharmacies are currently not nearly exploiting their full potential in terms of the use of digital interfaces such as apps. Furthermore, a similar development can be found in Figure 12 when it comes to purchasing medical products online rather than going to stationary pharmacies. Only 29% of all respondents are regularly buying medical products online, leaving 71% who are not purchasing or only rarely purchasing pharmacy products online. Respondents that are regularly purchasing medical products online are more likely to use pharmaceutical apps. This implies that current users of digital solutions connected to pharmacies actively inform themselves about which and how many technologies make sense regarding their health concerns.

Approximately 7% of the respondents are spending more than EUR 35 per month in pharmacies, which is not enough to launch better pharmacy delivery systems in Germany. Even though pharmacies mostly represent normal retail concepts, only 50% of the interviewed customers stated they compare the prices of their medical products. In addition to that, only 14% inform themselves about offers and discounts in their local pharmacies. This means that most pharmacies are not aware of customers’ needs or wishes and thus are not able to increase sales based on marketing concepts and discount campaigns. As a result, pharmacies can only respond to customer requests instead of deliberately and proactively directing them and pushing multiple sales.

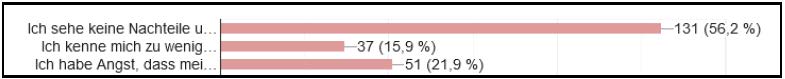

Even though in Figure 13 most respondents answered that digitalization in pharmacies would have no disadvantages, over 40% were scared of data leaks due to digital technologies or admitted to knowing too little about the application of digital interfaces. It is important to address these fears for pharmacies to be able to roll out future digital projects easier and to reach higher customer satisfaction indices. These concerns most definitely arise from the lack of usage of actual digital technologies connected to pharmacy systems and the lack of knowledge of the possible designs and functions of digital solutions.

Overall, the potentials of pharmacies regarding digital developments are very large and currently not even close to being fully exploited. As pharmacies are quite old and traditional businesses, it is exceptionally hard to break up the image of traditional pharmacies. Most patients acknowledge the necessity of digital changes within traditional pharmacy structures but are unable to realize the actual benefits of digital solutions. This results from the lack of integrated digital technologies in pharmacies today, giving most customers no need to use digital interfaces connected to their pharmaceutical care. In most cases, the average German customer only visits a pharmacy when he has to, buying only what he needs. Therefore, customers do not see pharmacies as part of “everyday needs” retail stores, which results in low sales per customer. As most customers choose the nearest pharmacy to purchase their medicines only because of the vicinity, the fundamental convenience would already exist to roll out improved digital sales systems with delivery options. Nevertheless, pharmacies have so little information about their customers that implementing digital sales systems would mean zero guarantees of increasing total sales. Moreover, most customers mainly prefer buying their medicines after direct consultation with their local pharmacist instead of buying them on the internet.

5. Conclusions and Outlook

Digitalization in healthcare can be an opportunity or a risk for all 18,753 of the stationary German pharmacies. While the total health sector is growing each year, the total number of German pharmacies shows a decreasing trend. In other words, fewer pharmacies are making more sales, while pharmaceutical online suppliers are emerging. Pharmacies that can implement basic digital technologies into their traditional processes will have a decisive advantage in the increasingly competitive market compared to fully analog pharmacies. Facing the fact that the pharmaceutical market has been sleeping a lot in recent years, basic digital changes start with the development of attractive homepages, the use of Google My Business services, and the integration of online sales channels. Even though customers can receive information about specific medicines in many digital ways, the number one method remains asking a local pharmacist for help. This proves that pharmacists still have a high reputation among patients who trust pharmaceutical consultation over many other methods and thus buy more directly in local pharmacies. Hence, freeing up pharmacists’ time on an everyday basis is key to developing better consultation services and reaching higher sales. To start, pharmacies have to fully automate their warehouse systems, including the integration of stock management systems based on their previous sales data, processed by Big Data technologies. At the same time, more efficiency in the general flow of goods in pharmacies enables the expansion of fully automated, 24/7 sales counters, where patients can easily pick up their required medication by receipt or preordering. As a result, pharmacists can spend more time on individual patient consultations rather than wasting time on easy-to-change processes. In the future, apps and other mobile technologies will also play a major role in the purchasing process of medicines, as more and more digitally adept generations get older and therefore need more medicines. Thus, pharmacies have to integrate their local offerings and consulting services into digital mobile health applications to become visible to online buyers. To increase digital sales, the use of Big Data tools for analyzing all of the online buyers’ behavior becomes essential.

In conclusion, the combination of all these changes should ensure the survivability of stationary pharmacies in the future of healthcare. Thus, to not lose sales or customers, pharmacies have to set digitalization as the number one priority on their agenda. AI, Big Data, and other technologies will help pharmacies to gain more efficiency and generate more income by working closer together with their patients. Knowing and listening to what customers of individual pharmacies want determines which changes to make in the future. Pharmacies therefore have to become more actual businesses to ensure their employees’ jobs are retained.

Author Contributions

Both authors contributed equally to the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Friesdorf, M.; Deetjen, U.; Sawant, A.; Gilbert, G.; Niedermann, F. Digital Health Ecosystems: A Payer Perspective; McKinsey & Company: Germany, 2019; https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/digital-health-ecosystems-a-payer-perspective (accessed on 3 January 2022).

- Elektronische Patientenakte. Available online: https://www.bundesgesundheitsministerium.de/elektronische-patientenakte.html (accessed on 3 January 2022).

- English, L. Virtual Healthcare Is The Future—If Organizations Can Clear These Hurdles. Forbes. https://www.forbes.com/sites/larryenglish/2021/09/19/virtual-healthcare-is-the-future--if-organizations-can-clear-these-hurdles/?sh=1e44c0e6705f (accessed on 19 September 2021).

- Statista. Global digital health market forecast 2025 | Statista. https://www.statista.com/statistics/1092869/global-digital-health-market-size-forecast/ (accessed on 3 January 2022).

- Bagaria, N.; Laamarti, F.; Badawi, H.F.; Albraikan, A.; Martinez Velazquez, R.A.; El Saddik, A. Health 4.0: Digital Twins for Health and Well-Being. In Connected Health in Smart Cities; el Saddik, A., Hossain, M.S., Kantarci, B., Eds.; Springer International Publishing: Cham, Switzerland, 2020; pp. 143–152. [Google Scholar]

- Thilo Kaltenbach. Health 4.0 made in Germany: Global digital health market is booming, Europe is one of the three regions to look at—Germany is now creating connected infrastructure. Germany, April 2019. https://www.gtai.de/resource/blob/4340/c18e32891211674a19e3922608f21c53/presentation-dmea-2019-kaltenbach-roland-berger-data.pdf (accessed on 6 January 2022).

- German Pharmacies—Figures, Data, Facts 2021; ABDA—Federal Union of German Associations of Pharmacists: Germany, 2021.

- Statista. Öffentlichen Apotheken—Arbeitsplätze in Deutschland bis 2020 | Statista. https://de.statista.com/statistik/daten/studie/5065/umfrage/anzahl-der-arbeitsplaetze-in-oeffentlichen-apotheken/ (accessed on 3 January 2022).

- Wolff, D.; Göbel, R. (Eds.) Digitalisierung: Segen oder Fluch; Springer: Berlin/Heidelberg, Germany, 2018. [Google Scholar]

- Tsekleves, E.; Cooper, R. Emerging Trends and the Way Forward in Design in Healthcare: An Expert’s Perspective. Des. J. 2017, 20, S2258–S2272. [Google Scholar] [CrossRef]

- Compu Group Medical. The electronic health record - the heart of healthcare communication. 2021. Available online: https://www.cgm.com/corp_en/magazine/articles/corporate/2021/the-electronic-health-record-the-heart-of-healthcare-communication.html (accessed on 6 January 2022).

- Afferni, P.; Merone, M.; Soda, P. (2018, June 18—2018, June 21). Hospital 4.0 and Its Innovation in Methodologies and Technologies. In Proceedings of the 2018 IEEE 31st International Symposium on Computer-Based Medical Systems (CBMS), Karlstad, Sweden, 18–21 June 2018; pp. 333–338. [Google Scholar]

- Deutschland. iOS—Gesundheit. Available online: https://www.apple.com/de/ios/health/ (accessed on 4 January 2022).

- Official google.org Blog: Tracking Flu Trends. Available online: http://blog.google.org/2008/11/tracking-flu-trends_31.html#:~:text=flu%20trends (accessed on 14 January 2022).

- Deutschland. ResearchKit und CareKit. Available online: https://www.apple.com/de/researchkit/ (accessed on 5 January 2022).

- EpiWatch—Digital Health for Epilepsy. EpiWatch—Digital Health for Epilepsy. Available online: https://www.epiwatch.com/ (accessed on 5 January 2022).

- E-Health. Available online: https://www.bundesgesundheitsministerium.de/service/begriffe-von-a-z/e/e-health.html (accessed on 5 January 2022).

- Adibi, S. Mobile Health; Springer International Publishing: Berlin/Heidelberg, Germany, 2015; Volume 5. [Google Scholar]

- Malvey, D.; Slovensky, D.J. mHealth; Springer: New York, NY, USA, 2014. [Google Scholar]

- Statista. Smartphone Users 2026 | Statista. https://www.statista.com/statistics/330695/number-of-smartphone-users-worldwide/ (accessed on 5 January 2022).

- Byambasuren, O.; Beller, E.; Glasziou, P. JMIR mHealth and uHealth—Current Knowledge and Adoption of Mobile Health Apps Among Australian General Practitioners: Survey Study. Available online: https://mhealth.jmir.org/2019/6/e13199/ (accessed on 5 January 2022).

- Nordlinger, B.; Villani, C.; Rus, D. Healthcare and Artificial Intelligence; Springer International Publishing: Berlin/Heidelberg, Germany, 2020. [Google Scholar]

- Artificial Intelligence In Healthcare Market Report, 2021-2028. Available online: https://www.grandviewresearch.com/industry-analysis/artificial-intelligence-ai-healthcare-market (accessed on 6 January 2022).

- Encyclopedia Britannica. Artificial Intelligence | Definition, Examples, Types, Applications, Companies, & Facts. 6 January 2022. Available online: https://www.britannica.com/technology/artificial-intelligence.

- Paaß, G.; Hecker, D. Künstliche Intelligenz: Was steckt hinter der Technologie der Zukunft? Springer eBook Collection; Springer: Fachmedien Wiesbaden: Wiesbaden, Germany, 2020. [Google Scholar]

- Hodges, A. Alan Turing and the Turing Test. In Parsing the Turing Test; Epstein, R., Roberts, G., Beber, G., Eds.; Springer: Dordrecht, The Netherlands, 2009; pp. 13–22. [Google Scholar]

- PricewaterhouseCoopers. Künstliche Intelligenz in der Gesundheitswirtschaft. Available online: https://www.pwc.de/de/gesundheitswesen-und-pharma/wie-kuenstliche-intelligenz-das-gesundheitssystem-revolutioniert.html (accessed on 6 January 2022).

- Tjiptomongsoguno, A.R.W.; Chen, A.; Sanyoto, H.M.; Irwansyah, E.; Kanigoro, B. Medical Chatbot Techniques: A Review. In Software Engineering Perspectives in Intelligent Systems; Advances in Intelligent Systems and Computing, Silhavy, R., Silhavy, P., Prokopova, Z., Eds.; Springer International Publishing: Cham, Switzerland, 2020; Volume 1294, pp. 346–356. [Google Scholar]

- College of Computing, Terri Park | MIT Schwarzman. Behind Covid-19 Vaccine Development. 6 January 2022. Available online: https://news.mit.edu/2021/behind-covid-19-vaccine-development-0518 (accessed on 6 January 2022).

- The German Healthcare System. 2010. Available online: https://link.springer.com/content/pdf/10.1007/s13167-010-0060-z.pdf (accessed on 6 January 2022).

- Statistisches Bundesamt. Gesundheitsausgaben in Deutschland. 24 September 2019. Available online: https://www.destatis.de/DE/Themen/Gesellschaft-Umwelt/Gesundheit/Gesundheitsausgaben/_inhalt.html (accessed on 6 January 2021).

- Costigliola, V. (Ed.) Advances in Predictive, Preventive and Personalised Medicine; Healthcare Overview; Springer: Dordrecht, The Netherlands, 2012; Volume 1. [Google Scholar]

- Micheal Burkhart, R.-J.P. Sherlock in Health. PricewaterhouseCoopers. June 2017. Available online: https://www.pwc.nl/en/publicaties/sherlock-in-health.html (accessed on 6 January 2022).

- Statista. Germany—The Average Age of the Population 1950–2050 | Statista. Available online: https://www.statista.com/statistics/624303/average-age-of-the-population-in-germany/ (accessed on 7 January 2022).

- Constantia Salfiliou-Rothschild. The Responsibility of Older People for High Healthcare Costs. CESifo Forum. 2009. Available online: https://www.google.de/url?sa=t&rct=j&q=&esrc=s&source= web&cd=&cad=rja&uact=8&ved=2ahUKEwjZ2KiC45_1AhUM6qQKHfCOALUQFnoECAcQAw&url=https%3A%2F%2Fwww.ifo.de%2FDocDL%2Fforum1-09-special3.pdf&usg=AOvVaw1OR9kLzBSCzBj1cEH7KE4C (accessed on 7 January 2022).

- Bevölkerungspyramide: Altersstruktur Deutschlands von 1950–2060. Available online: https://service.destatis.de/bevoelkerungspyramide/index.html#!y=2034&l=en (accessed on 7 January 2021).

- Uchibayashi, M. An etymology of pharmacy in the Western languages. Yakushigaku Zasshi 2003, 38, 205–209. [Google Scholar] [PubMed]

- Zebroski, B. A Brief History of Pharmacy, 1st ed.; Routledge: London, UK, 2015. [Google Scholar]

- Adka—eng Bundesverband deutscher Krankenhausapotheker e.V. Bundesverband Deutscher Krankenhausapotheker e.V. 2021. Available online: https://www.adka.de/en/ (accessed on 12 January 2022).

- Statista. Germany: Number of Hospitals 2019. Available online: https://www.statista.com/statistics/578444/number-of-hospitals-germany/ (accessed on 12 January 2022).

- Pharmaziestudium, Pharmazie Studieren, PTA-Ausbildung | Nützliche Informationen Rund um das Pharmaziestudium. Aufbau des Pharmaziestudiums. 2012. Available online: https://pharmaziestudium.org/aufbau-pharmaziestudium/ (accessed on 7 January 2022).

- EPhEU—Employed Community Pharmacists in Europe. Germany—More about pharmacy—EPhEU—Employed Community Pharmacists in Europe. 28 February 2018. Available online: https://epheu.eu/germany-more-about-pharmacy/ (accessed on 12 January 2022).

- www.dictionary.com. Definition of drug | Dictionary.com. Available online: https://www.dictionary.com/ browse/drug (accessed on 12 January 2022).

- Prescription Drugs and Over-the-Counter (OTC) Drugs: Questions and Answers. FDA. Available online: https://www.fda.gov/drugs/questions-answers/prescription-drugs-and-over-counter-otc-drugs-questions-and-answers (accessed on 12 January 2022).

- Www.shop-apotheke.com. SHOP APOTHEKE ▷ Online Apotheke für Deutschland. Available online: https://www.shop-apotheke.com/ (accessed on 12 January 2022).

- agilie.com. Best Pharmacy Apps to INSPIRE You in 2021 | Agile App Development Company Blog. Available online: https://agilie.com/en/blog/best-pharmacy-apps-to-inspire-you-in-2020 (accessed on 12 January 2022).

- Gesund.de. gesund.de. Available online: https://www.gesund.de/?gclid=CjwKCAiAlfqOBhAeEiwAYi43 F5QS9qSyVwRmfIBgNQNfkOKwND9p1aqNfgZhibYTSMCiQ6Wb-YZ4NRoCD6oQAvD_BwE (accessed on 12 January 2022).

- Friedemann Schmidt, M.A. Pharmacy 2030: Perspectives on the provision of pharmacy services in Germany. ABDA—Federal Union of German Associations of Pharmacists: January 2015, Germany.

- Walgreens Boots Alliance. United States Segment. 2020. Available online: https://www.walgreensbootsalliance.com/our-business/united-states-segment (accessed on 13 January 2022).

- Hyken, S. Walgreens: At The Corner Of Technology And A Better Customer Experience (CX). Forbes. 8 July 2017. Available online: https://www.forbes.com/sites/shephyken/2017/07/08/walgreens-at-the-corner-of-technology-and-a-better-customer-experience-cx/?sh=3cc0d50832c9 (accessed on 13 January 2022).

- Markt Intern. gesund.de—wie läuft‘s und wie geht es Weiter? Available online: https://www.markt-intern.de/branchenbriefe/gesundheit-freizeit/apothekepharmazie/p-2021-51/gesundde-wie-laeufts-und-wie-geht-es-weiter/ (accessed on 13 January 2022).

- Startseite | GFD Gesundheit für Deutschland GmbH & Co. KG. Available online: https://gesund-versorger.de/ (accessed on 31 December 2021).

- CVS Prescription Delivery Service | CVS Health. Available online: https://cvshealth.com/our-services/pharmacy-services/prescription-delivery (accessed on 13 January 2022).

- Gölzer, B. BD Rowa—Beraten & Verkaufen. 14 January 2022. Available online: https://rowa.de/de/loesungen/beraten-verkaufen/ (accessed on 14 January 2022).

- BA: Fachkräftemangel bei Apothekern und Pharmazeuten. Available online: https://www.abda.de/aktuelles-und-presse/newsroom/detail/ba-fachkraeftemangel-bei-apothekern-und-pharmazeuten/ (accessed on 15 January 2022).

- Artificial Intelligence in Pharmacy: Are You Ready? 22 January 2018. Available online: https://www.wolterskluwer.com/en/expert-insights/artificial-intelligence-in-pharmacy-are-you-ready (accessed on 15 January 2022).

- Councils, F. This CTO Says AI Technology Is Transforming The Pharmacy Industry In Time To Battle The Pandemic. Forbes. 31 July 2020. Available online: https://www.forbes.com/sites/forbesmarketplace /2020/07/31/this-cto-says-ai-technology-is-transforming-the-pharmacy-industry-in-time-to-battle-the-pandemic/?sh=47ebaca115f7 (accessed on 15 January 2022).

- Alanazi, A.; Al Rabiah, F.; Gadi, H.; Househ, M.; Al Dosari, B. Factors influencing pharmacists’ intentions to use Pharmacy Information Systems. Inform. Med. Unlocked 2018, 11, 1–8. [Google Scholar] [CrossRef]

- Baty, A. Hey Alexa, Why Isn’t My Pharmacy Using Natural Language Processing? OmniSYS. 15 July 2020. Available online: https://www.omnisys.com/natural-language-processing-pharmacy/ (accessed on 15 January 2022).

Figure 1.

Growth of the global digital health market from 2015 to 2025. Reprinted with permission from Ref. [6]. 2019, Roland Berger.

Figure 1.

Growth of the global digital health market from 2015 to 2025. Reprinted with permission from Ref. [6]. 2019, Roland Berger.

Figure 2.

Apple ResearchKit as an example of intelligent digital healthcare solutions [15].

Figure 2.

Apple ResearchKit as an example of intelligent digital healthcare solutions [15].

Figure 3.

Prognosis of AI in healthcare market size from 2016 to 2028. Reprinted with permission from Ref. [23]. 2022. Grand View Research Inc.

Figure 3.

Prognosis of AI in healthcare market size from 2016 to 2028. Reprinted with permission from Ref. [23]. 2022. Grand View Research Inc.

Figure 4.

Artificial intelligence applications in healthcare. Reprinted with permission from Ref. [28]. 2020, Springer Nature.

Figure 4.

Artificial intelligence applications in healthcare. Reprinted with permission from Ref. [28]. 2020, Springer Nature.

Figure 5.

The age structure of the German population in 2021 and 2040. Reprinted with permission from Ref. [36]. 2022, Statistisches Bundesamt Deutschland.

Figure 5.

The age structure of the German population in 2021 and 2040. Reprinted with permission from Ref. [36]. 2022, Statistisches Bundesamt Deutschland.

Figure 6.

The division of prescription and non-prescription pharmaceuticals in Germany in 2015. Reprinted with permission from Ref. [7]. 2021, ABDA – Federal Union of German Associations of Pharmacists.

Figure 6.

The division of prescription and non-prescription pharmaceuticals in Germany in 2015. Reprinted with permission from Ref. [7]. 2021, ABDA – Federal Union of German Associations of Pharmacists.

Figure 7.

Order service in gesund.de as a mobile application for pharmacies [47]. 2022, gesund.de GmbH.

Figure 7.

Order service in gesund.de as a mobile application for pharmacies [47]. 2022, gesund.de GmbH.

Figure 8.

An example of a possible concept of stationary pharmacy retail in the future. Reprinted with permission from Ref. [54]. 2022, Becton, Dickinson & Co.

Figure 8.

An example of a possible concept of stationary pharmacy retail in the future. Reprinted with permission from Ref. [54]. 2022, Becton, Dickinson & Co.

Figure 9.

The scope of extended pharmacy information systems of the future. Reprinted with permission from Ref. [58]. 2018, Elsevier.

Figure 9.

The scope of extended pharmacy information systems of the future. Reprinted with permission from Ref. [58]. 2018, Elsevier.

Figure 10.

The necessity of digitalization in the healthcare sector with a focus on pharmacies (A3 Survey, data on file, 2022).

Figure 10.

The necessity of digitalization in the healthcare sector with a focus on pharmacies (A3 Survey, data on file, 2022).

Figure 11.

Actual usage of mobile applications connected to pharmacies (A3 Survey, data on file, 2022).

Figure 11.

Actual usage of mobile applications connected to pharmacies (A3 Survey, data on file, 2022).

Figure 12.

Purchase of medical products via the internet (A3 Survey, data on file, 2022).

Figure 13.

Disadvantages of digitalization in pharmacies (A3 Survey, data on file, 2022).

© 2022, Copyright by the authors Licensed as an open access article using a CC BY 4.0 license